Japan Lump-sum Pension Refund, Tax Refund - YouAT LLC

About Japanese Pension Refund (Lump-sum Withdrawal Payment)

1.Who can claim Japanese pension refund?

Non-Japanese persons who worked and paid pension contributions in Japan(Kosei Nenkin / Kokumin Nenkin / Kyosai Nenkin)can claim refunds of their contributions within 2 years since leaving Japan. This payback system is called “Lump-sum Withdrawal Payments”. Details are shown on the guidance pages of Japan Pension Service.

Persons who fulfill the following conditions can claim their pension refunds:

(1)They are not a Japanese citizen,

(2)They have paid Japanese pension contributions from 6 months to 10 years,(※), and

(3)They don't reside in Japan now.

(※)Minimum period for a qualification to claim old age pension (basically after 65 years old) is currently 10 year's enrollment. PR holders have a shorter period. Please see this blog article.

All in all, the majority of foreigners who worked in Japan in a short period with working visas are to get qualified to claim their pension refunds after leaving Japan.

(Some countries have Social Security Agreements with Japan to totalize both countries' pension enrollment periods. The latest list of these countries are shown on this blog article.

Even if your citizenship is included in this list, though, you can claim your pension refund to Japan, of course.)

To satisfy the condition (3) you need to apply for "notification of moving-out (転出届[tenshutus todoke, てんしゅつとどけ] in Japanese)" just before you leave Japan, to the municipal office where you are registered as a resident.

So if you claim your pension refund please apply for “notification” to the municipal office just before you leave Japan.

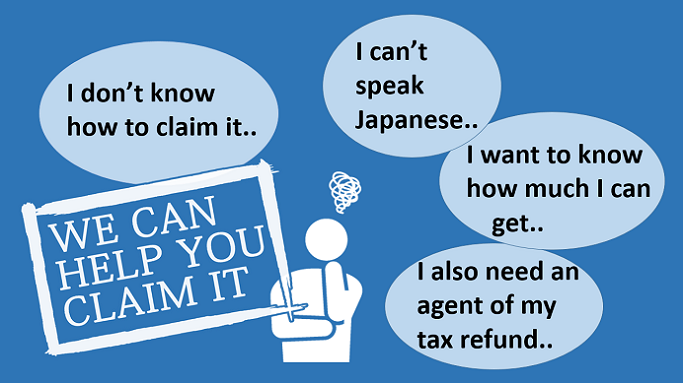

2.YouAT LLC carries out total process of pension refunds

YouAT LLC carries out TOTAL PROCESS of claiming pension refunds legally.

We can also refund 20% tax as a tax agent, and our fees are set well under 20% tax.

We examine all of your documents before claiming and help you succeed in your refund surely.

We claim both your pension refund and its 20% tax refund, and send them to your bank account.

- We send needed documents to you via email, and examine all of your documents before claiming. Please send completed documents to us.

- A claiming period can be 3 to 4 months at shortest and around half a year in long cases.

- Mailing costs and transaction fees of financial institutions don’t be included in our fee.

- Before claiming, we get a research and tell you the estimated sum of your pension refund. Our fee will be set according to the estimated sum.

- But it is possible that the real sum of your pension refund will deviate slightly from the estimation. If that happens it is possible that we recalculate our fee, and kick back some to you or deduct additionally from the refund.

- Pension refunds and 20% tax refunds are sent abroad by international currencies. Please see the page 13 of the guidance of Japan Pension Service. If you designate the bank account in Japan, though, your pension refund and 20% tax refund will be sent by JPY.

- 12.5% of the amount of pension refunds(Lump-sum Withdrawal Payments)

- If we apply for “notification of moving-out” on behalf of you, +5,000yen is added

(Self-Claiming/Tax Refund by us)

Please claim your pension refund by yourself, agreeing with our explanation. If you succeed in your claim, you will get 80% of it.

- Please send us (1) “Notice of Entitlement: Your Lump-sum Withdrawal Payments”, that is mailed to you from Japanese authority and (2) Tax agent designation form, that we will show you. If you lost it we will reissue it with the additional fee of 5,000yen.

- We refund 20% tax of your pension refund. A tax refund will take around 1 to 3 months. We send refunded tax into your bank account after we deduct our fee from it.

- Mailing costs and transaction fees of financial institutions don’t be included in our fee.

- 25% of the refunded tax

- If you lost “Notice of Entitlement: Your Lump-sum Withdrawal Payments”,+5,000yen is added for its re-issue cost.