Japan Lump-sum Pension Refund, Tax Refund - YouAT LLC

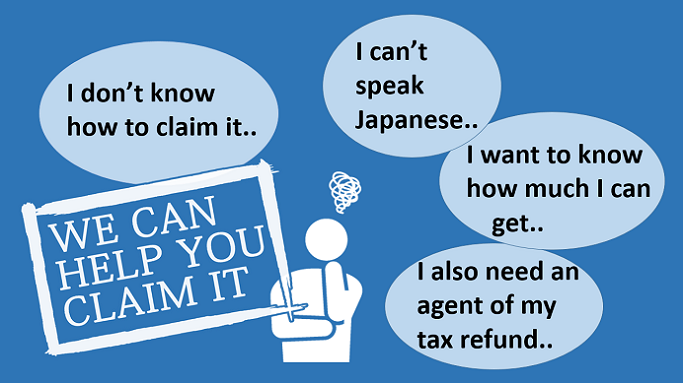

Question for Japan pension refund

To claim it what should I do before leaving Japan?

Non-Japanese persons can claim lump-sum pension refunds (Lump-sum Withdrawal Payments) on the conditions that

(1)You are not a Japanese citizen,

(2)You have paid Japanese pension contributions from 6 months to 10 years, and

(3)You don't reside in Japan now.

All in all, the majority of foreigners who worked in Japan in a short period with working visas are to get qualified to claim their pension refunds after leaving Japan.

They can claim their pension refunds within 2 years after leaving Japan.

To satisfy the condition (3) you need to apply for "notification of moving-out (転出届[tenshutustodoke, てんしゅつとどけ] in Japanese)" just before you leave Japan, to the municipal office where you are registered as a resident.

So if you claim your pension refund please apply for “notification” to the municipal office just before you leave Japan.

YouAT LLC is entitled to apply for “notification” on behalf of you. We can give you a service to apply for "notification" if you have no time to go to the municipal office before leaving Japan.

How long does it take until its payoff?

《AMOUNT OF REFUND》

It depends on how much and for how many months you paid pension contributions.

Roughly speaking,

- If you work in Japan 1 year then you will be able to receive nearly 1 month's "average standard remuneration".

- If you work in Japan 2 years then you will be able to receive nearly 2 month's "average standard remuneration".

- If you work in Japan 3 years or more then you will be able to receive nearly 3 to 5 month's "average standard remuneration".

Your "average standard remuneration" is calculated by the Japanese law according to (but not always equal to) averaging your salaries and bonuses you got in Japan. More detail information is shown on this article of our blog.

YouAT LLC will give you a free research of the estimated sum of your pension refund before giving you our service.

《CLAIMING PERIOD》

We instruct you to prepare documents in order to claim your pension refund as fast as possible.

Please prepare documents and mail us them quickly. In the fastest cases, payments (except for 20% tax) are transferred in 4 to 5 months after we receive claiming documents.

20% tax refunds take another 1 to 3 months.

Basically non-Japanese persons can claim lump-sum pension refunds (Lump-sum Withdrawal Payments) within 2 years after leaving Japan, on the conditions that

(1)You are not a Japanese citizen,

(2)You have paid Japanese pension contributions from 6 months to 10 years, and

(3)You don't reside in Japan now.

If you have paid contributions more than 10 years then you are qualified to claim old age pension after age 65, and can't claim lump-sum pension refund.

For details of Japanese old age pension, plesase see YouAT's another website.

“Act on Labor and Social Security Attorney” entitles exclusively Labor and Social Security Attorney (社会保険労務士 in Japanese) to be an agent for claiming Japanese pension refunds.

YouAT LLC has Sumida Masanori Labor and Social Security Attorney & Administrative Scrivener as one of its members, so we can carry out foreigners’ pension refunds legally.

Since our start-up in 2009 we have had more than 200 clients per 1 year, and we have received high appreciations from many customers having worked in Japan.

Do I need to visit your company?

Your pension refund will be sent to your bank account directly. 20% will be its income tax, thatYouAT LLC will claim to refund and send to your bank account.

YouAT LLC will deduct our fee from 20% tax refund before it is sent. Basically, You don’t have to send any money to us.

YouAT LLC sends and receives all of your documents through emails and postal mailing services. You don’t have to visit us.

You can do it yourself, of course.

But there are challenges you face when you claim your pension refund from abroad:

- If there are any defects in documents, your claim isn’t accepted and sent back to you.

- You must use Japanese to ask the government questions to gather information how your claim goes.

- 20% of pension refunds are withheld as income tax according to “Japanese Tax Act”. So you will get only 80% of total refund if you claim it by yourself.

According to “Japanese Income Tax Act”, this 20% tax can be almost fully refunded if you designate a tax agent in Japan.

YouAT LLC carries out TOTAL PROCESS of your pension refund in abroad, and refund its 20% as well. We examine all of your documents before claiming and help you succeed in your refund surely.

Our fees are set well under 20% tax. So we can send you “refunded tax minus our fee” into your bank account. We have the system to send more than 80 % of foreigners’ pension refunds to our customers.